BDO Transfer Pricing Alert - Issue 1 | January 2024

BDO Transfer Pricing Alert - Issue 1 | January 2024

We are very pleased to introduce you to the launch of BDO Switzerland’s Transfer Pricing (TP) alerts, a publication by BDO Switzerland. This publication is intended to brief you on the recent TP developments and updates in Switzerland.

In this edition, we highlight the Swiss safe harbour interest rates and the precautions to be taken when applying them to intercompany financial transactions.

We trust that you will find this TP alert informative and useful. If you need further information on any of the topics featured or would like to discuss its implications on you or your business, you may get in touch with our financial TP specialists.

Swiss Safe Harbour (CHF interest rates)

Circular Letter Framework 2024

This week, the Swiss Federal Tax Administration (SFTA) published the Circular Letter No 207 updating the applicable safe-harbor interest rates for intercompany transactions for the fiscal year 2024 (FY24).

1. Switzerland (lender) to Related Party Abroad (borrower)

The minimum interest rate suggested by the SFTA for loans granted by a Swiss entity to its related parties in Swiss francs (CHF) are as follows:

| Types of loans | Minimum interest rate |

|---|---|

| Loans financed with equity | 1.5% |

| Loans financed with external debt (up to CHF 10 million) | Third party interest rate + 50 basis points spread (0.5%) (at least 1.5%). |

| Loans financed with external debt (exceeding CHF 10 million) | Third party interest rate + 25 basis points spread (0.25%)(at least 1.5%). |

This represents no change in the CHF minimum lending rate from 2023.

2. Switzerland (borrower) from Related Party Abroad (lender)

The maximum interest rate suggested by the SFTA for loans granted by a related party to a Swiss entity in Swiss francs (CHF) should be calculated using the minimum lending rate in CHF increased by a specific spread, as follows:

| Types of loans | Maximum interest rate | |

|---|---|---|

| Operating loans | ||

| Swiss operating company | CHF 1 million or less | 3.75% (BR + spread) |

| Exceeding CHF 1 million | 2% (BR + spread) | |

| Swiss holding or asset management | CHF 1 million or less | 3.25% (BR + spread) |

| Exceeding CHF 1 million | 1.75% BR + (BR + spread) | |

This represents no change in the CHF maximum lending rate for loans up to CHF 1 million and a decrease of 25 basis points (0.25%) for loans exceeding CHF 1 million for 2024 compared to 2023.

Swiss Safe Harbour (foreign currency interest rates)

3. Switzerland (lender or borrower) to Related Party Abroad (borrower or lender)

The minimum/maximum interest rate suggested by the SFTA for loans granted/received which are equity financed in foreign currency are as follows:

| Country | Currency | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|---|---|

| EU | Euro | 0.75% | 0.75% | 0.50% | 0.25% | 0.50% | 3.00% | 2.50% |

| US | USD | 3.00% | 3.00% | 2.25% | 1.25% | 2.00% | 3.75% | 4.25% |

| AU | AUD | 3.00% | 3.00% | 1.50% | 1.00% | 1.50% | 4.25% | 4.25% |

| BR | BRL | NA | 9.50% | 6.00% | 5.75% | 11.25% | 12.75% | 10.25% |

| CA | CAD | 2.75% | 3.25% | 2.50% | 1.50% | 2.50% | 3.75% | 3.50% |

| CN | CYN | 3.50% | 4.25% | 3.75% | 3.75% | 3.75% | 3.00% | 3.00% |

| DN | DKK | 0.75% | 1.00% | 0.75% | 0.50% | 0.50% | 3.25% | 3.00% |

| UK | GBP | 1.75% | 1.75% | 1.50% | 1.00% | 1.25% | 5.25% | 3.75% |

| HK | HKD | 2.25% | 3.25% | 2.50% | 1.50% | 1.50% | 4.25% | 3.00% |

| IN | INR | NA | 7.75% | 7.50% | 6.25% | 6.25% | 7.00% | 7.00% |

| IL | ILS | NA | 1.25% | NA | NA | 1.25% | 3.25% | 3.75% |

| JA | JPY | 0.50% | 0.50% | 0.50% | 0.50% | 0.50% | 0.50% | 0.50% |

| PL | PLN | 2.75% | 3.00% | 2.50% | 1.50% | 1.50% | 7.00% | 4.75% |

| SW | SEK | 0.75% | 1.00% | 0.75% | 0.75% | 1.00% | 3.25% | 2.75% |

| SG | SGD | 2.25% | 2.75% | 2.25% | 1.25% | 1.50% | 4.00% | 3.00% |

| ZA | ZAR | 7.50% | 8.50% | 7.75% | 5.75% | 6.50% | 8.75% | 8.25% |

| AE | AED | 3.25% | 3.25% | 2.75% | 2.00% | 2.50% | 4.00% | 4.25% |

4. Switzerland (lender) to Related Party Abroad (borrower)

For loans in foreign currency financed with external debt, the minimum safe harbor interest rate should be estimated as follows:

- Third party or related party debt financing costs (%).

- Plus a margin of 0.50% applies (0.25% for the portion of loans above CHF 10 million only).

5. Switzerland (borrower) from Related Party Abroad (borrower)

For loans in foreign currency financed with external debt, the determination of the maximum interest rate to Swiss entities under the safe harbour rules, should be calculated based on this table.

However, the difference between the CHF minimum and maximum interest rates could be added as follows:

- operating loans of a trading company a spread of 2.25% (for loans up to CHF 1 million) and 0.50% (for loans exceeding CHF 1 million).

Financial Markets

Arm's length interest rates

Financial markets exhibit high volatility and are susceptible to external shocks. Market interest rates are subject to rapid and frequent fluctuations. In the present economic climate, there has been a substantial decrease in interest rates within the markets. This reduction can be attributed to the monetary policies implemented by major central banks, which aim to lower interest rates due to the absence of significant short-term inflation concerns.

Due to various factors such as the upcoming US elections, elections in several European countries, and real estate crises in China, among others, we anticipate substantial market volatility in 2024. It is important to note that the Swiss safe harbour rates, while accepted in Switzerland, may not necessarily align with arm's length interest rates. As a result, they could face challenges abroad.

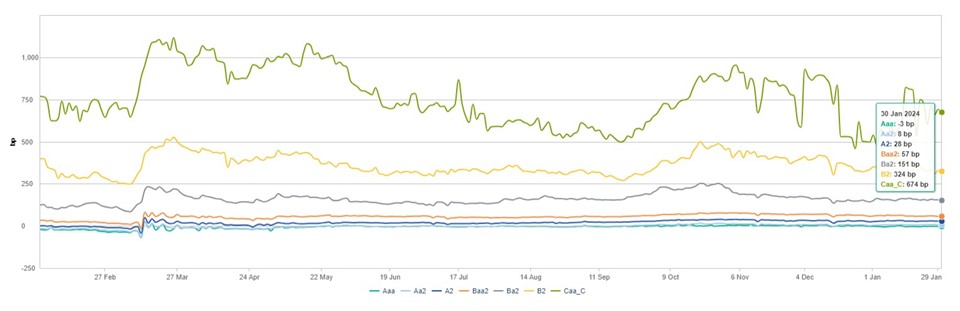

Bonds Over SOFR - Spreads by Rating

The graph below shows the spread over the SOFR curve for different credit ratings. Bond-implied ratings are derived from spreads on publicly traded corporate bonds. For example, if a company has a credit rating of Aaa (AAA), the market interest rate should be 5.29% (SOFR (5.32%) + spread (-3BP)), while a company with a credit rating of Caa (CCC+) should be 12.06% (SOFR (5.32%) + spread (674BP)).

Conclusions

The utilization of Swiss safe harbour interest rates, which are currently notably lower than market (arm's length) interest rates, may face scrutiny from foreign tax authorities. This is because it implies that the foreign entity lending the money to Switzerland is doing so at a rate potentially below market rates.

The safe harbour interest rates are intended to simplify the intercompany financing for Swiss taxpayers. In this sense, the Swiss tax authorities will allow deviations from these rates if the taxpayer conducts a transfer pricing analysis in accordance with the OECD guidelines. This analysis should consider factors such as the borrower's credit rating and benchmarking to support the application of the arm's length principle to the interest rate.